Have you prepped your brand’s New Year offers and deals to attract your customer base even as the ball drops on 2024? Are you sure your message reached its intended audience and registered with them this year?

There are over 150 nationalised, private, and cooperative banks in India. The financial services industry is crowded with nearly 5,000 SEBI-registered brokers and 9,480 NBFCs. Getting your brand voice heard in this sea of financial institutions (FIs) is challenging. For a niche swamped with complex concepts and regulatory guardrails, the path to the customer’s heart has additional obstacles. Your content strategy must be aligned not just to the customer but also to your brand’s policies and the regulatory framework of your jurisdiction of operation. Here are a few tips to give your finance content writing a makeover for 2025.

Elevate Your Blogging Strategy

Blogs are the go-to mechanism to build trust, establish industry leadership, and demonstrate expertise. The internet, however, is known for infobesity, with abundant short- and long-form content. So, your content needs to stand out, be ranked high and motivate the customer to NOT swipe away.

Balance Education and Awareness

Shift the focus from selling your offerings to helping customers. Educational content is much appreciated by today’s consumer, who values autonomous decision-making. So, consider different types of educational content – how-to, whys, process breakdowns, and tips. Financial management is an essential and under-discussed part of life. Turn your website into a go-to place for all kinds of customers – from beginners to finance veterans.

This HDFC Securities’ Roots home page provides readers with quick access to all content formats – blogs, videos, podcasts, and even small bytes. Blog tags enable effortless navigation to the content type of the visitor’s choice. The blog list includes tips, education, and market insights, everything a trader needs to learn about the financial markets and make trading decisions.

Address Latent Search Indexing (LSI)

Search engines are now AI-powered. While the right keywords are still important, related terms add value to the content. It helps the search engine assign high relevance and comprehensive coverage metrics to your content. In fact, Google’s search algorithm prioritises search intent, which is the purpose of a user’s search. Therefore, addressing the user’s intent will help your financial content rank higher.

Download our whitepaper:

The Ultimate Guide to Content Marketing for Financial Institutions

Include Content that Drives Decision-Making

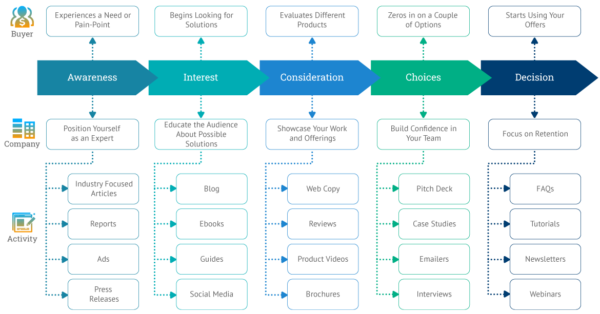

From awareness to conversion, the customer goes through a multi-step funnel. So, financial content writing strategies should address every stage of this sales funnel. For instance, BOFU (bottom of the funnel) content helps the customer choose your brand. This works for those closer to the buying stage. This means, when your digital strategy has already acquired their attention or they are actively looking to get a job done.

Websites that Rank and Engage

Customers who discover a brand via social media or peer recommendation usually do two things – check reviews and visit the official website.

Building testimonials requires a great post-sales strategy, in addition to exceptional products and services. You probably know that better than us. But we can lend insights from our expertise for creating a website they do not want to leave.

Diversify Content Formats

While text is critical, text-only is borderline boring. Let your audience choose the format in which they want to consume your content. Use carousels, videos, infographics, and more to offer a variety of content. Interactive live streams and webinars work great too.

Here’s some wisdom on Choosing Content Writers for the BFSI Industry

Demonstrate Purpose Driven-ness

Digital generations are increasingly growing immune to flashy marketing. They are more purpose-driven and openly voice their opinions. The emerging cohort is likely to pay extra for sustainable, socially driven, and responsible brands. While doing good is important, ensuring that your audience recognises your ESG initiatives is equally important.

Citi’s “The Moment” advertisement addresses on the issue of the gender pay gap. It focuses on a single problem and elicits strong emotions. It ends with a rather simple solution to resolve the problem.

Bites that Can Be Easily Digested

The financial space is perceived as complex by most consumers. Therefore, simplifying financial concepts is paramount. The key is to focus on one thing at a time and make it easily digestible for the user. This is the age of micro-content, where 10-second reels blow up the internet rather than an 18-minute monologue. Make the content quickly consumable.

Be it Digital Sakhi or Sachet Kumar, L&T Finance has a distinct voice and messaging tone for its verticals. These are more likely to resonate with the audience to whom they matter the most. Their visuals form an instant connection and disseminate information in a way that is quick and easy to understand at a glance.

Soul-Stirring Social Media

Are you posting boring content to push products like the newspapers of the 1990s? Give your social media a PERSONALITY.

Having a social media presence and harnessing the power of this ubiquitous medium are two very different things. Users are more likely to engage with a social media account that feels real and relatable.

Human Emotions to Connect

Express enthusiasm for the weekends, own up to your mistakes and show how you fixed things, and get mad over social issues. Expressing emotions and solidarity can help you connect deeply with your audience. However, stay authentic and consistent with your brand voice. The way you deliver a message can reinforce or undermine an idea.

Maintain a Steady Flow

Remember the old saying – out of sight, out of mind? Have a weekly/monthly calendar to maintain a steady flow of material because on social media, your competitors will quickly grab the audience you lose.

Engage Your Audience

The GRWM trend doesn’t fit finance brands. No Problem. Do a “build my gifting budget.” Finance AMAs could also work well – they would promote two-way dialogue while disseminating information.

Social media is one place that has a lot of room for experimenting. So, make sure you have a variety of content to keep your audience engaged. From educational tips to entertaining quips on social media trends, make sure your social profile is vibrant and multi-faceted.

Conduct polls, ask for opinions and include them in product/service development. FIs cannot usually do this through traditional channels. Rewarding users for engagement could be a great strategy to push customers further along the sales funnel.

Good financial content writers know how to give surprise and shock therapy to keep clients engaged with different forms content. Veda Informatics has over two decades of experience writing finance content for domestic and global brands, including articles, website content, video scripts, blogs, infographics, whitepapers, and social media posts. Talk to us to give your content strategy an edge in 2025.

Leave A Comment

You must be logged in to post a comment.