Dogecoin started as a joke. When founders Billy Markus and Jackson Palmer designed a cryptocurrency using the popular grammatically challenged Shiba Inu meme dog as a mascot in 2013, they did not intend to create a feasible alternative to Bitcoin (BTC). Instead, they set out to make a crypto that invited intrigue due to its use of the Doge meme, while also being impractical to hold. It was meant to be a welcoming joke to the crypto sphere and an educational blockchain experiment for new crypto buyers and innovators to learn from.

That was 8 years ago. Since then, an onslaught of retail investors into the crypto space, spurred on by Tesla CEO Elon Musk, have generously rewarded the meme-coin. A YTD rise in 2021 of 645% has built DOGE a market capitalization of $41 billion. At its peak on May 3, 2021, the coin had a market cap of a whopping $91 billion. To give you a sense of how huge that number is, consider this – it’s twice that of Ford Motor Company! It’s no more held as a gateway coin but forms an increasingly crucial part of the portfolio of many retail investors. The coin is breaking out from being a joke, and it has a lot going for it.

What’s in the Doggie Bag?

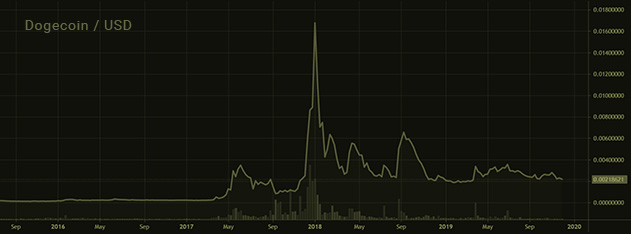

Through the majority of Dogecoin’s history, it has languished at prices below 8 cents. Unlike Bitcoin (BTC), the DOGE has no limit to the coins mined. DOGE’s creators, Markus and Palmer, decided to make the coin inflationary with the express intent of rendering it undesirable to alt hoarders. DOGE was created as a means to an end – to use the popular doge meme to draw attention to the crypto-field to encourage more research and development in the crypto universe. Users were to experiment with the cheap coin, have a laugh, and then explore the rest of what the crypto world had to offer. DOGE was created as a currency to be spent rather than a speculative asset to be held.

More Than Just Puppy Love

As DOGE matured, developers capped inflation at new issues of 5 billion coins per year, which means the inflation rate reduces annually. The growing community bought into the “Do Only Good Everyday” (DOGE) philosophy of its developers, using the coin to promote good causes and underdogs. The DOGE community used the coin to fund the Jamaican bobsleigh team’s attendance at the Sochi Olympics in 2014. The tropical nation had had a cult following in the Winter Olympics, after the unlikely qualification of its inexperienced team in 1988. The campaign epitomized both the larky and the pro-underdog perspective of the community. It brought an incredible amount of good press from the likes of the Washington Post and The Guardian. DOGE also helped fund underdog NASCAR driver Josh Wise’s race on the famous Talladega Superspeedway. Plastered with DOGE advertising, Wise’s car was dubbed the “Moonrocket” after the community’s famous meme-slogan of “To The Moon”.

The community also stepped up to reimburse victims of a Doge-wallet hack in 2013, funded an Indian luger’s Sochi Olympics campaign, and contributed to a charity building clean water projects in Kenya. DOGE at its core was a joke, but it had found utility in punching up to the powers that be and propelling the underdogs forward. For a coin with no store of value benefits, this alternative utility gave it staying power. DOGE continues to find utility in donation and tipping, including on social media sites such as Reddit.

Founders Markus and Palmer, however, walked away from their project in 2015, citing concerns that sections of the DOGE community were starting to turn toxic. The joke was unravelling; incidentally, this was in the context of a prolonged crypto bear market, especially in BTC. DOGE spent the rest of the decade languishing at a fraction of a cent, despite being continuously worked on by volunteer developers.

Every Dog Has Its Day

Since the pandemic-induced global recession in 2020, risk appetite has rapidly grown. The post-pandemic recovery has been epitomized by the growth of the SPAC space, the rise of Robinhood, the GME short squeeze and increased crypto interest. BTC, for example, has spiked more than 400% since January 2020 (more than 720% at its ATH in March 2021).

If ever there was a year made for DOGE to be pulled away from its lethargic sideways price movement, it is 2021. DOGE was made for a bull market, with a flood of novice retail investors preferring the familiarity of the Shiba Inu meme, despite DOGE’s limited utility and the insistence by its core community that it is a joke.

Bull markets love a story – DOGE has a great one. In addition, there is a sense of comfort in holding whole coins, given DOGE’s low price. Novice investors may prefer to hold 1 DOGE rather than 0.00001 BTC.

The Tail That Wagged the Dog

And then there is Elon Musk. The Tesla founder has flexed his muscles in the crypto world, with the car manufacturer deciding to hold $1.5 billion in BTC reserves rather than cash and accept BTC as payment. The decision prompted a 20% rise in the weakened BTC market in February 2021. BTC realized gains contributed $100 million to Tesla’s income statement, but criticism of high energy costs associated with BTC mining made Musk backpedal on the decision to accept Bitcoin. BTC tumbled 13% in response, highlighting the power of the Musk brand to influence crypto with a market cap of over $1 trillion.

Musk is no stranger to the influence of branding on market valuation. Tesla currently trades at a trailing PE of 608, with its valuation dwarfing traditional carmakers with higher earnings and turnovers. Investors have bought into Musk’s philosophy of Tesla being a technology company that happens to make cars. Tesla is priced as an autonomous driving solution, despite their self-driving software hitting multiple roadblocks and delays recently. As history has shown, it’s difficult to place an upper limit on tech’s potential in a bull market.

With Musk’s penchant for branding, it is little wonder that he has found himself attracted to DOGE. The meme format has an accessibility that has made the coin more popular than other arguably more useful altcoins such as Ethereum and Cordano and more understandable than complex Defi (decentralized finance) projects. Musk found with DOGE a project that his personal brand would help. Compared to BTC associated with DOGE’s mining model, the lower energy costs have also been attractive to the second richest man in the world. DOGE developers have reportedly been working with Musk since 2019 to improve transaction efficiency on the system and make it a true greener alternative to BTC.

In 2019, Musk won an April’s Fools Day Twitter poll to be DOGE’s CEO, a joke position Musk embraced, calling DOGE his favorite crypto. Musk’s tweet – One Word: DOGE – in December 2020 truly set off the DOGE rally, causing a price bump of 25%. Since then, Musk has been enthusiastic about his support for the coin through social media, and a tweet in April invoking the community’s “To the Moon” slogan with a painting of a “doge” barking at the moon – the market responded by giving DOGE a 260% price bump.

In May, the moon links were taken even more literally, with Musk announcing that Space-X will accept payment in DOGE for payloads in its 2022 lunar mission dubbed “DOGE-1”. Musk has stepped hard on aligning the DOGE brand with himself, and the crypto’s value has benefited.

Who Let the Doge Out?

DOGE’s status as a meme-coin and its limited utility continue to be a deterrent to institutional investment. However, the crypto has absorbed retail investment even as interest in BTC has wavered. DOGE might not have a future as a store of value, but in DOGE, Musk has under his wing a crypto with an appealing potential as a method of transfer. The flood of new investors shares his inspiration for innovation-led growth and the ability to fund it globally through crypto.

Musk’s challenge, however, is to maintain price stability in the coin so that users can draw feasible contracts to finance business. The new investors are not as up for a joke as the DOGE’s classic good-humored brand of good Samaritan holders. Its utility has ostensibly shifted away from rewarding funny and underdog causes. DOGE prices dived after Musk joked on Saturday Night Live about DOGE, including referring to it as a “hustle”. DOGE’s structures are not conducive to maintaining speculative prices, probably even less so than Tesla stock. Musk might see DOGE as it was meant to be – a joke with the potential to punch up to traditional power structures that he can remodel to finance large scale projects. He just has to be careful in making sure that the investors he has inspired understand. If he fails, his experiment in adopting DOGE to fund innovation may well turn into the final joke.

Leave A Comment

You must be logged in to post a comment.