US stocks closed higher on the last trading day of the week, also wrapping a year in which the markets went through a rollercoaster ride. Wall Street plummeted sharply in February and March with the coronavirus outbreak spreading outside China, which forced several countries to impose lockdown restrictions, bringing economic activity to a grinding halt.

Despite the initial shock, markets rebounded sharply, especially after the Federal Reserve stepped up with various measures to help the economy. The latest surge in equities follows the rollout of covid-19 vaccines and the announcement of another stimulus package.

The Nasdaq gained a whopping 43.6% in 2020, with tech stocks surging to record highs amid lockdowns. The S&P 500 added 16.3%, while the Dow Jones settled the year with 7.3% gains.

Performance of US Indices

Wall Street achieved new record highs on Thursday, following upbeat data on weekly jobless claims, which fell to 787,000 in the week ending December 26, coming in better than the forecast of 828,000.

The Dow Jones Industrial Average added 196.92 points to close at 30,606.48 on Thursday, gaining 1.3% for the week. The S&P 500 rose 0.6% to 3,756.07, adding 1.4% last week. The tech-laden Nasdaq index rose 0.14% on the last trading day and added 0.7% for the week.

Top US Stocks of the Week

Weibo Corporation’s (NASDAQ: WB) shares declined around 14% on Monday after the company released results for the third quarter.

Shares of China Finance Online Co. Limited (NASDAQ: JRJC) tumbled 21% on Wednesday after the company reporting a third-quarter loss of 66 cents per share. The company’s stock ended the week 11% lower.

Shares of Celsius Holdings, Inc. (NASDAQ: CELH) gained over 13% on Thursday on news of the company being set to replace Capri Holdings in the S&P SmallCap 600 from January 7. Celsius shares added 17% for the week.

Ebang International Holdings Inc’s (NASDAQ: EBON) shares jumped over 23% on Thursday, after the company announced plans to launch a cryptocurrency exchange in the first quarter of 2021. Ebang ended the week 26% higher.

Performance of European Indices

European markets closed lower on the last trading day of the year. Market sentiment was hurt by the UK government announcing stricter restrictions following the rapid spread of a new variant of the coronavirus.

The pan-European Stoxx 600 index fell 0.3% on the New Year’s Eve, closing down 4% for the year, but adding 0.8% last week. London’s FTSE index closed lower by 1.45% on Thursday, recording a decline of 0.6% last week and down 15% for the year.

Top European Stocks of the Week

Deutsche Post’s shares gained around 3% on Monday after the German company’s CEO projected record profits for 2020.

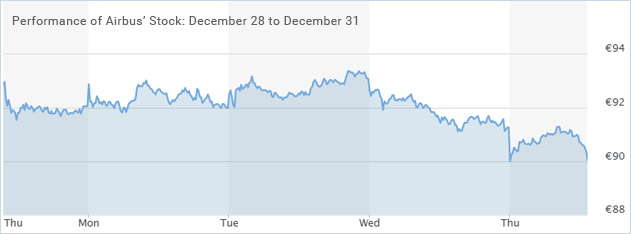

Shares of Airbus fell around 2% on Thursday after US trade officials announced plans to raise tariffs on certain European Union products.

Saipem’s stock gained 4% on Thursday after the Italian company announced a deal with the Italian navy.

The Forex Market

The British pound rose sharply versus the US dollar last week following the signing of a last-minute Brexit trade deal. However, investor sentiment was impacted by Britain enforcing tighter restrictions following the spread of the more contagious variant of the covid-19 virus. The GBP/USD gained more than 0.8% last week.

The Australian dollar began the week on a lower note but rallied strongly during the course of the week. The trading volume remained low due to the holiday season. The AUD/USD pair added over 1.1% last week.

The Crypto Market

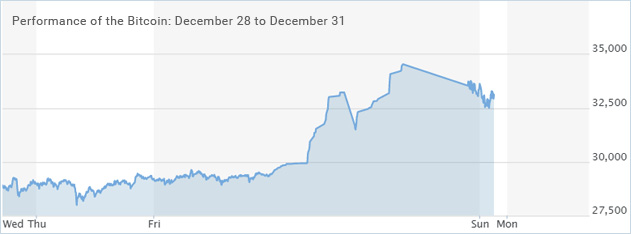

The world’s largest cryptocurrency, Bitcoin, continued to shatter new records, surpassing the $30,000 mark for the first time in history, just a few weeks after crossing another major resistance level.

The currency gained more than 13% on Saturday to cross $33,100, after having added around 50% in December, when the digital currency exceeded $20,000 for the first time.

Leave A Comment

You must be logged in to post a comment.