Artificial intelligence (AI) has already done wonders to transform the finance sector, redefining products and services and enhancing reach. Now, with the introduction of Generative AI (GenAI), banking is experiencing a paradigm shift, with the technology powering real-time customer interactions at scale, fraud detection and prevention in real-time, and proactive addressing of customer needs.

PwC’s 27th Annual CEO Survey, held in 2024, shows that business leaders, especially from the banking industry, expect GenAI and machine learning to drive cost optimization, create new revenue streams, and improve customer experience. That’s not all, 66% of these CEOs are also optimistic about the technology playing a critical role in increasing revenue and profitability.

The ability of GenAI to analyze massive datasets, recognize trends and patterns, and make data-driven decisions lends the technology to multiple use cases. Let’s take a closer look at how this form of AI is redefining banking for industry players and their customers.

Enhancing Customer Experience

Possibly, the most prominent application of GenAI in banking is the sophisticated chatbots that can offer human-like interactions 24/7. These virtual assistants can handle a wide variety of inquiries, from checking account balances to comparing investment products. They can personalize the interactions based on the customer’s history. The ability of GenAI to process natural language allows banks to offer real-time assistance for complex financial queries and troubleshooting, improving issue resolution rates and, therefore, customer satisfaction. When a virtual assistant can guide a customer through the loan application process, it frees up manpower, which can then be better used for core business functions.

HDFC securities, a subsidiary of Indian banking giant, HDFC Group, has used this technology to great effect with Arya, its Smart Virtual Assistant. It is just what today’s investors, who value self-determination, look for since it powers DIY investments, portfolio checking, and much more. The chatbot can also offer personalized investment recommendations, based on the individual’s existing portfolio and investment history.

Personalized Banking

GenAI’s ability to analyze vast amounts of data is a boon for banking. It allows financial institutions to develop personalized products, such as credit cards, loans, and investment plans tailored to the financial goals and risk appetite of individual customers. It also helps with dynamic pricing, with fees and rates being adjusted in real-time, based on customer profiles, market conditions, and financial behavior patterns. In fact, GenAI can analyze data from multiple sources, including non-traditional channels, like social media, to personalize products and services.

Poland-based PKO Bank Polski uses GenAI for risk assessments and predictive analysis to offer personalized product recommendations while minimizing the risk of miss-selling financial services that do not meet the customer’s needs.

Fraud Detection and Cybersecurity

GenAI powers precise risk assessment and lending decisions for banks by streamlining research and due diligence. In addition, cybersecurity is strengthened via real-time monitoring of transactions and other activities to identify anomalous behaviors that might signal fraud. This reduces response time, allowing better fraud prevention by raising timely red flags. In fact, banks can proactively ensure security through predictive analysis to identify potential vulnerabilities. GenAI also facilitates adapting to evolving threat scenarios. AI is playing a crucial role in fortifying cybersecurity in banking through threat intelligence. Vast datasets are analyzed, such as access logs and network traffic, to identify potential security breaches early for prompt countermeasures.

JPMorgan Chase has successfully implemented artificial intelligence to fight sophisticated fraud attempts. The fraud detection mechanism relies on advanced models to continuously analyze transaction data to build typical customer behavior profiles.

Protect your finance brand and customers by staying updated on existing and emerging cyber threats.

Read about the most prominent threat to the finance sector in our blog: Is Your Brokerage Ahead of Cyber Criminals?

Improving Operational Efficiency

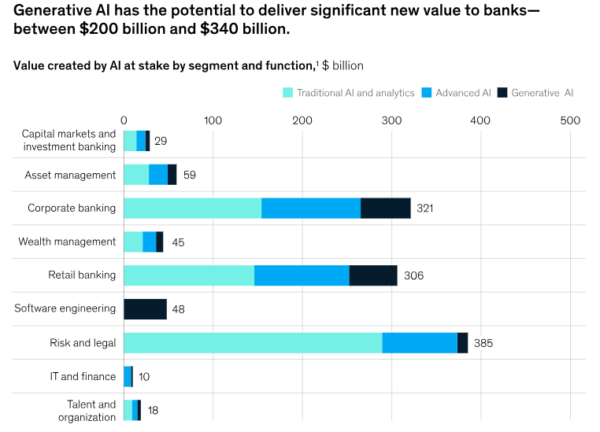

An invaluable application of AI in banking is the automation of routine back-office tasks, such as verification of information, claim processing, and document processing. With its ability to process large language models (LLMs), GenAI also powers banks to automate financial reporting. Financial institutions are better positioned to make the most of the huge data volumes available to them to generate realistic and informative financial scenarios and perform sophisticated risk simulations. The technology also provides access to quick, comprehensive, and accurate credit scoring for informed lending decisions. Most importantly, it plays a crucial role in making financial services accessible to underserved and unserved populations. All this leads to cost savings, improved revenue generation, and higher profitability.

Easing Compliance

Compliance processes can be automated and streamlined with GenAI, increasing efficiency in meeting regulatory requirements across jurisdictions and reducing the risk of human error. The technology can also facilitate the continuous monitoring of regulatory updates to ensure continued compliance. Automating reporting, and KYC and AML checks also makes compliance more efficient, reducing the risk of penalties and reputational damage.

Implementing GenAI in Banking

Despite the diverse benefits of AI in banking, integrating the technology isn’t without its challenges. A survey by EY-Parthenon revealed that the lack of sufficient internal expertise, budget constraints, and legacy tech infrastructure are major concerns for banking decision-makers. In addition, a large percentage of banking executives stated that they were “waiting for further developments and testing before prioritizing front-office use cases.” They also expressed concerns about the uncertainty around evolving regulations associated with the technology. Yet, 90% of the respondents also said that they had 90% allocated resources to exploring and/or deploying the use cases of GenAI in banking.

During such disruptive times, communicating your commitment to implementing the latest technology tools to provide highly convenient and on-demand products and services is crucial. Veda Informatics, with over two decades of experience establishing financial brands as thought leaders, deeply understands the value of effective communication. Speak to us to learn how we can help you with a multi-channel communication strategy to engage your target audience.

Leave A Comment

You must be logged in to post a comment.