India is home to Asia’s oldest stock market, the BSE, and the world’s largest derivatives market by number of contracts, the NSE. Yet, only 3% of Indian households actively invest in the stock market. Millennials turned to the financial markets only after the pandemic led to economic uncertainties and made time available for them to learn about managing, maintaining and growing their finances. Indians have only become more aware of #YMYL since then.

The result? The retail investor population in the Indian stock market snowballed in 2020, with the number of individual demat account holders growing 1.4 times at NSDL and a whopping 3.2 times at CDSL from 2020 to 2022. As of January 2023, there were a total of about 11 crore demat accounts.

Some of the reasons why we’re seeing a greater affinity for stock trading include:

- A lack of alternative investment instruments with substantial returns.

- Hassle-free digitised KYC processes for opening accounts.

- Accessibility of financial education, free of cost.

- Availability of easy-to-use trading apps for mobiles and desktops.

Additionally, Indian brokerages are evolving to provide the necessary tools and analyses to aid informed investing for their customers.

Here’s a round-up of the 3 best brokers in India to help you trade like a pro in 2023.

1. Zerodha

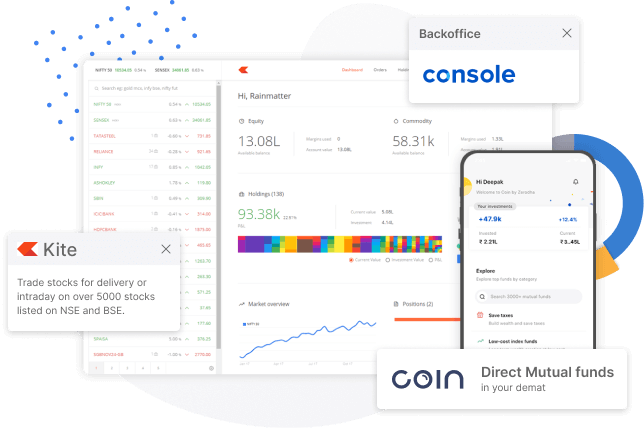

Zerodha is the undisputed market leader with over 1 crore registered clients and 18.3% of the national retail trading volume. The brokerage shot to fame with its revolutionary pricing model with low brokerage and zero fees for equities and mutual funds. The discount broker has earned customers’ trust with flexible technology for all experience levels and transparency across its multiple trading and educational resources. It has a total of 6,447,055 active clients.

Image Source: https://zerodha.com/open-account/

Image Source: https://zerodha.com/open-account/

Zerodha boasts being a zero-debt company and allows users to create trading, demat and commodity accounts. Kite, its mobile app, has a rating of 4.2 on Google’s Play Store and over 312,000 reviews. Its top features include a floating order window and the facility to view market depth with streaming notifications.

The broker facilitates investing in equities, futures and options. Traders can also directly invest in mutual funds or government bonds and apply for IPOs. Additionally, it allows users to gift trading instruments, such as stocks, ETFs, gold bonds and mutual funds.

Despite being among the best brokers in India, Zerodha does have a few drawbacks. Firstly, it does not offer a Trinity account (3-in-1 savings, trading and demat account). Secondly, app updates have a record of affecting client activity, although the reported issues are quickly resolved.

2. Angel One

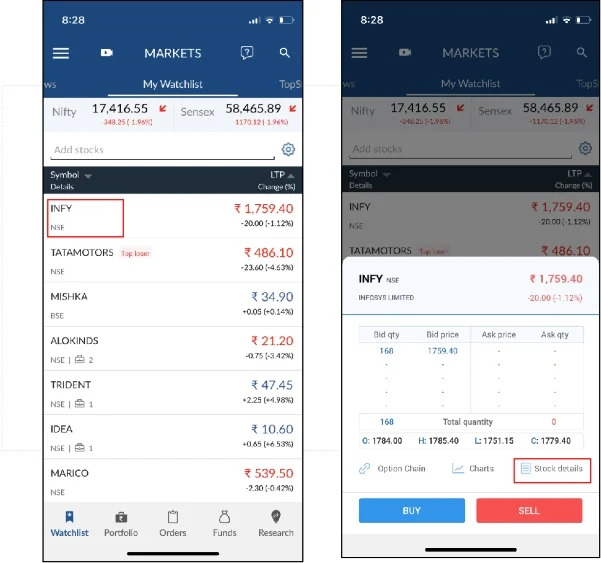

The distinguishing factor for Angel One is that it is a full-service brokerage with the prices of a discount broker. The hybrid format has led to its popularity as one of the oldest brokerages in the country, with over 25 years in the business. The brokerage reported 11.8% market share as of November 2022. It has the largest network of sub-brokers and franchise offices, and over 11,000 branches across the country. The brokerage’s client base rose by 52.2% yoy and reached 13.3 million in February 2023.

Image Source: https://www.angelone.in/knowledge-center/online-share-trading/stock-overview-your-guide-to-stocks-on-angel-one

Image Source: https://www.angelone.in/knowledge-center/online-share-trading/stock-overview-your-guide-to-stocks-on-angel-one

Angel One’s desktop and mobile trading platforms offers the flexibility of anytime/anywhere trading. The popular robo-advisory platform, Angel One ARQ, is free of cost and offers stock and mutual fund recommendations, complete with fundamental and technical analyses. The tool also helps with IPO research. The advanced analytics facilities make it a favourite among users. It can even double up as a fund manager for users’ portfolios and hand-hold beginners until they are ready to trade on their own. Additionally, “Prime” account holders get a dedicated Relationship Manager and 24×7 services. What more could a trader want?

A major drawback, however, is that customers get margin funding without notice. This may affect trading strategies, since traders have to pay the associated interest rate. So, traders have to be cautious of their account’s credit and debit at all times. Just like Zerodha, a missing 3-in-1 demat account is a turnoff for some traders.

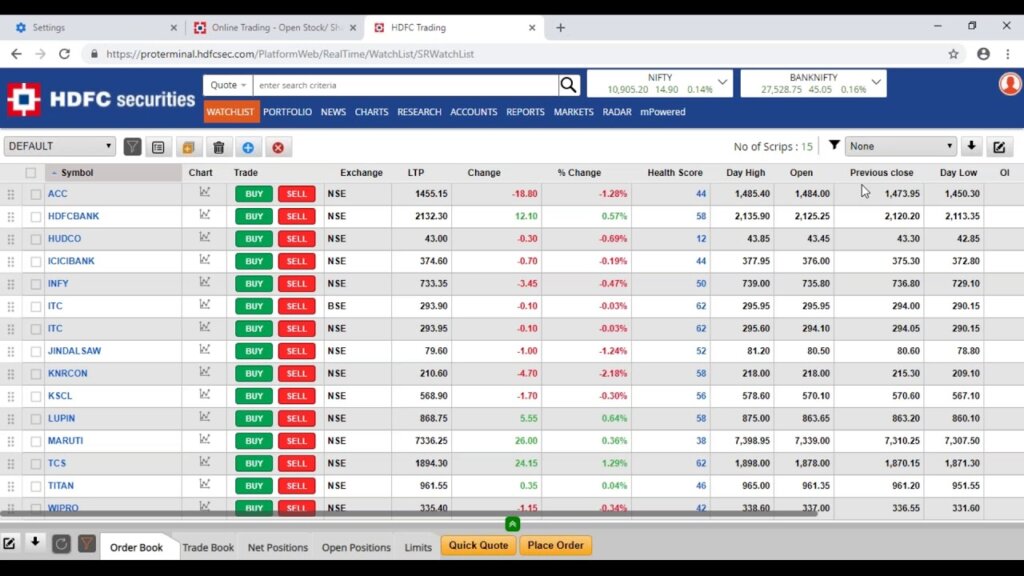

3. HDFC securities

The one-stop-shop for all investment needs, HDFC securities is a leading full-service brokerage in India. It is registered with SEBI, a member of NSDL, CDSL, as well as NSE, BSE and MCX. Its USP is the 3-in-1 savings, demat, and trading account. The complaint-to-client ratio is 0.01%, the lowest in the industry across platforms. HDFC securities had 1,089,646 active clients as of February 2023. The Android mobile app is rated 4.3 on Google’s Play Store and has over a million downloads.

Image Source: https://www.hdfcsec.com/market/equity

Image Source: https://www.hdfcsec.com/market/equity

This is one of the best brokers that is backed by a large private bank, HDFC Bank. The mobile and desktop trading platforms are beginner-friendly and facilitate investments in a wide range of instruments, including forex, commodities, stocks, ETFs, government bonds, and even US stocks. It charges the lowest brokerage fees among all the traditional full-service brokerages, along with multiple subscription plans. All users get 24×7 assistance over a phone call. Fingerprint login, customisable visual displays, multiple watchlists and custom real-time price updates are some of the most loved features, as per user reviews. The platform is suitable for all trader levels, from global traders to conservative gold investors.

The only shortcoming is its slightly higher brokerage fee than its digital-age counterparts, but traders don’t mind paying the fee due to the multiple facilities they get.

Make the Right Choice

Choosing a broker with low brokerage fees and multiple facilities can be difficult for a beginner. But asking the right questions can help you evaluate your options better. Here are a few questions you can ask before finalising whom you trust with your money:

- How credible is the brokerage and what does data say about it?

- How much experience does the brokerage have?

- Are there any hidden charges?

- How often is the analysis technology updated and how relevant is it for your market of interest?

- What kind of customer support does the brokerage offer and what do customers to say about it?

- What instruments can you trade? Do they align with your financial goals?

- What are the fund transfer facilities and withdrawal delays?

- Does the brokerage offer trader education?

India has hundreds of brokerages with an array of offerings. It is the experience level of the trader and their financial goals that determine which one will work best for them.

Leave A Comment

You must be logged in to post a comment.