Last week started on a downbeat note for Wall Street, after stocks finished November with historic gains, with the Dow recording its strongest monthly surge since 1987.

The week progressed with positive news related to the coronavirus vaccine being approved by the UK, following the completion of late-stage trials. Pfizer and its German partner BioNTech grabbed the headlines, having received regulatory authorization for the emergency use of their covid-19 vaccine candidate.

Meanwhile, coronavirus cases continued to surge in the US, with the country reporting a record number of daily cases, hospitalizations, and deaths on Thursday. Around 217,664 cases were reported in the US on that day, with more than 100,000 hospitalizations.

Performance of US Indices

Wall Street stocks spiked to record highs on Friday despite the Labor Department reporting weaker-than-expected job additions for November. The US economy created 245,000 jobs last month, much lower than the consensus estimates of 440,000. Investor sentiment was lifted by a decline in the unemployment rate to 6.7% in November, from 6.9% in the previous month. Some traders considered the downbeat jobs data a positive sign, as this could pressurize lawmakers to approve the new fiscal stimulus package.

The Dow Jones Industrial Average climbed 248.74 points to close at 30,218.2 on Friday, while the S&P 500 rose 0.9% to settle the session at 3,699.12. The tech-laden Nasdaq Composite moved higher by 0.7% to close at 12,464.23. All three indices closed at their record highs in Friday’s session.

Top US Stocks of the Week

Moderna, Inc’s (NASDAQ: MRNA) shares climbed more than 20% on Monday after the company reported its covid-19 vaccine efficacy rate at 94.1%.

Shares of IHS Markit Ltd (NYSE: INFO) rose over 7% on Monday after the company agreed to merge with S&P Global in an all-stock transaction.

BlackBerry Limited’s (NYSE: BB) stock spiked around 20% on Tuesday after the company announced a partnership with Amazon Web Services. Shares of BlackBerry gained more than 38% for the week.

Shares of Zoom Video Communications, Inc. (NASDAQ: ZM) dropped 15% on Tuesday despite the company posting better-than-expected quarterly results and providing strong guidance for the current quarter.

Patterson Companies, Inc’s (NASDAQ: PDCO) shares surged more than 15% on Wednesday after the company reported stronger-than-expected Q2 results. Patterson’s stick added around 17% last week.

Shares of NetApp Inc. (NASDAQ: NTAP) jumped more than 9% on Wednesday after the company disclosed upbeat Q2 earnings and issued strong Q3 earnings guidance. NetApp’s shares added around 13% last week.

Shares of BioNTech SE (NASDAQ: BNTX) climbed 6% on Wednesday on news of the company and its partner Pfizer received regulatory approval in the UK for their jointly developed coronavirus vaccine. BioNTech’s stock added over 9% last week.

Salesforce.com, Inc’s (NYSE: CRM) shares slipped around 9% on Wednesday after the company confirmed plans to acquire Slack Technologies and reported upbeat third-quarter results.

Shares of Waddell & Reed Financial, Inc. (NYSE: WDR) jumped more than 50% on Thursday after Macquarie Group announced plans to acquire the company for $1.7 billion.

Michaels Companies Inc’s (NASDAQ: MIK) shares climbed over 20% on Thursday after the company reported better-than-expected Q3 results. Shares of Michaels Companies added 18% last week.

Shares of Express, Inc. (NYSE: EXPR) plummeted 26% on Thursday after the company reported downbeat Q3 results.

Performance of European Indices

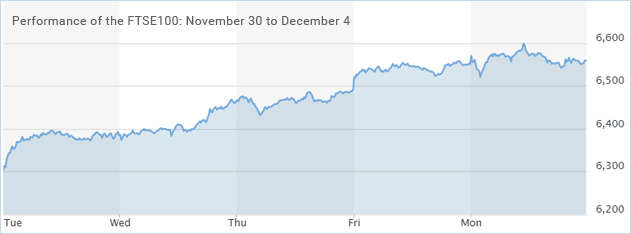

European markets ended higher on Friday on hopes of a Brexit trade deal being inked and the US announcing its new stimulus package. The IHS Markit Eurozone construction PMI climbed to 45.6 last month, versus a five-month low of 44.9 in October. The region’s retail trade grew 1.5% in October, versus a revised 1.7% decline in the prior month.

After adding 0.6% on Friday, the Stoxx Europe 600 closed the week higher by only 0.2%. The FTSE 100 rose 2.9% last week, after the UK because the first Western country to announce a regulatory clearance for a covid-19 vaccine. The German DAX 30 closed the week lower by around 0.3%, while the French CAC 40 gained 0.2%.

Top European Stocks of the Week

Shares of ABN Amro plunged around 9% on Monday after the Dutch lender disclosed plans to cut around 3,000 jobs by 2024 in order to save costs.

Shares of G4S gained more than 7% on Wednesday after GardaWorld lifted its takeover offer for the company to £3.68 billion.

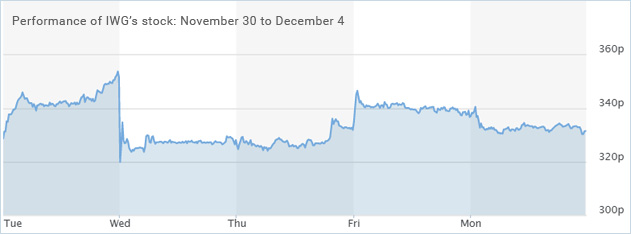

IWG’s shares slipped around 7% on Wednesday after the office provider announced a convertible bond offering worth £300 million.

Shares of H. Lundbeck climbed more than 8% on Friday after UBS rated the Danish pharmaceutical stock as a top pick for next year.

Latour’s shares slipped over 12% on Friday after the Swedish investment firm’s majority owner sold 10 million shares of the company.

The Forex Market

The euro surged to its strongest level since April 2018 versus the US dollar last week, as the safe-haven greenback weakened amid positive covid-19 vaccine news and hopes of additional US fiscal stimulus. The EUR/USD forex pair climbed more than 1.3% last week.

The Canadian dollar jumped to a two-year high level versus the greenback on Friday following a rise in crude oil prices and strong jobs data from the country. The Canadian economy added 62,000 jobs in November, while the unemployment rate eased to 8.5%. Both figures exceeded market expectations. Canada’s trade deficit also shrank to C$3.8 billion in October, with exports rising at a faster rate than imports. The loonie surged for the third consecutive week versus the greenback, adding 1.6% last week.

The Crypto Market

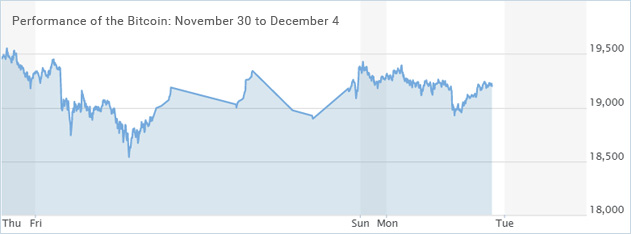

Last week proved to be a momentous one for the Bitcoin, as the digital currency notched a fresh high of $19,915. The rally took a breather, however, stopping just short of the major $20,000 resistance level. Bitcoin hovered around the $19,180 level over the weekend.

Leave A Comment

You must be logged in to post a comment.