The holiday-shortened week started on a positive note with another pharma company announcing development plans for its novel coronavirus vaccine candidate. Novavax disclosed on Monday that it had started the Phase 1 clinical study for its covid-19 candidate, NVX-CoV2373, and is expecting to release the preliminary results in July.

US stocks rallied last week, as the country starting to ease lockdown restrictions and various businesses expected to return to a growth track soon. Meanwhile, rising tensions between the US and China remained a cause for concern, with the Asian nation announcing new security legislation in Hong Kong. The US President held a press conference on Friday and markets feared some trade-related announcements as a retaliatory measure against China. However, President Trump refrained from any action related to the Phase I trade deal stuck between Washington and Beijing earlier this year, which helped supported market sentiment. The US President instead announced plans cut ties with the World Health Organization, claiming that the health agency was controlled by China.

Performance of US Indices

US stocks closed mostly higher on the last trading day in May and recorded strong gains for the week and month. The equity markets remained on a back foot for most of the session on Friday, with traders await the press conference called by President Donald Trump. Stocks rebounded during the last hour of the trading, with the press conference not being as disruptive as feared. Stocks posted strong gains last week on optimism around the lifting of lockdown measures imposed to control the coronavirus pandemic.

The Dow Jones Industrial Average, which fell around 17.53 points to end at 25,383.11 on Friday, posted a weekly gain of 3.8% adding to the previous week’s rally of 3.3%. The S&P 500 index added 0.5% on Friday and gained 3% in the week. The Nasdaq Composite Index, which has outperformed other major indices over the past couple of weeks, rose by just 1.8% last week. For the month, the Dow, S&P 500 and Nasdaq logged gains of 4.3%, 4.5% and 6.8%, respectively.

Top US Stocks of the Week

Shares of Hertz Global Holdings (NYSE: HTZ) plummeted more than 80% on Tuesday, after the company filed for Chapter 11 bankruptcy. The stock made a sharp rebound the next day, rising 136%. Shares of the Estero, Florida-based company lost 67% last week.

On Tuesday, LATAM Airlines Group’s (NYSE: LTM) stock tumbled 35% after the company filed for bankruptcy protection. The stock shed 59% last week.

Shares of Novavax (NASDAQ: NVAX) gained 4.5% on Tuesday after the company announced plans to begin the first phase of its covid-19 vaccine trials. The drug-maker’s shares still ended the week around 8% lower.

On Thursday, Dollar Tree’s (NASDAQ: DLTR) stock gained 12% following upbeat Q1 results. The stock climbed more than 20% over the week. Shares of Dell Technologies (NYSE: DELL) also rose on Thursday by 6%, following stronger-than-expected quarterly results. The stock gained 12% last week.

Shares of HP (NYSE: HPQ) dived more than 12% on Thursday, even after the company announced upbeat Q2 earnings. Investors were disappointed with HP missing sales expectations. The Palo Alto, California-based company also issued a downbeat earnings forecast for the third quarter. The stock ended the week down by 12%.

Performance of European Indices

European stocks declined on Friday with rising tensions between the US and China overshadowing strong rallies earlier in the week on prospects of a reopening of the economies.

The STOXX Europe 600 index declined by 1.6% on Friday, but still gained more than 3% since the beginning of May. The pan-European index was also on track to record its second consecutive month of gains after rising over 6% in April. London’s FTSE 100 index declined by 2.3% on Friday, while the German DAX 30 and French CAC 40 posted declines of 1.7% and 1.6%, respectively.

Top European Stocks of the Week

Shares of Tui spiked 52% on Tuesday, after Europe started to ease travel restrictions. The company’s shares jumped another 15% on Wednesday.

Rolls-Royce Holdings’ stock tumbled around 15% on Friday after S&P Global Rating lowered its credit rating of the engine maker to junk.

Renault’s shares also declined by around 8% after the company announced plans to cut 15,000 jobs globally.

The Forex Market

The British pound made strong gains versus the Japanese yen last week. The sterling broke above ¥132 during the week. This week is crucial for the British pound, as investors await new rounds of Brexit talks.

The US dollar continued its decline versus the euro on Friday, as the Eurozone’s common currency continued its upward momentum following the recently announced €750 billion recovery fund to help the European Union’s worst-affected economies. The euro breached the $1.1112 level on Friday, posting gains for the fourth straight day. The euro rose around 2% in the week against the greenback, recording its best weekly rise in around nine weeks.

The Crypto Market

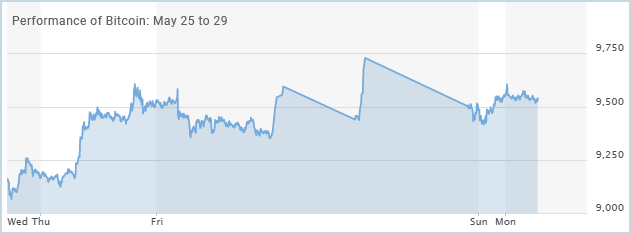

Bitcoin posted gains for most of last week but traded lower on Friday, as traders remained cautious ahead of US President Donald Trump’s news conference on China.

Bitcoin fell around 1% to trade at $9,400 on Friday, after rallying for two days when it climbed to $9,600 on Thursday. Over the weekend, the digital currency traded close to $9,595.

Leave A Comment

You must be logged in to post a comment.