The US Labor Department Friday reported a staggering 20.5 million job losses in the country in April, sending the unemployment skyrocketing to 14.7% amid shelter-in-place orders and factory closures to combat the COVID-19 pandemic. While the job losses and unemployment rate easily outpaced the records created post-World War II, they were better than the consensus forecasts of 21.5 million and 16%.

Performance of US Indices

US indices closed the week on a positive note, despite the spike in unemployment figures. The Dow Jones Industrial Average jumped 455 points to close the last day of the week at 24,331.32, booking a weekly gain of 2.6%. The S&P 500 index closed higher by 1.69% at 2,929.80 on Friday, up 3.5% for the week. The Nasdaq Composite Index outpaced all other major indices last week and erased its losses for 2020, rising 1.7% year to date. The tech-heavy index surged 6% last week.

Top US Stocks of the Week

Shares of PayPal Holdings jumped 14% on Thursday, despite the online payments giant missing estimates for the first quarter. PayPal projected strong trends in the upcoming quarter, with customers switching to online shopping. The stock closed the week higher by whopping 20%.

Shares of General Motors rose 3% on Wednesday, after the company reported stronger-than-expected figures for its first quarter. The automaker’s stock recorded gains of 14.5% for the week.

Walt Disney reported downbeat profits for its fiscal second quarter after the closing bell on Tuesday, although its revenues surpassed the consensus view. The stock remained broadly unchanged on the day but booked a weekly gain of 3.5%.

Performance of European Indices

European markets closed higher on Friday, booking gains for the week, as investors cheered signs of an improvement in the US-China trade relationship. The pan-European STOXX 600 index rose 0.9% on Friday, adding around 1.1% for the week. Italy’s FTSE MIB index rose 1.1% on the last day of the week, but closed lower by 1.5% for the week, ahead of Moody’s decision on the country’s sovereign debt rating. Germany’s DAX 30 rose 1.35% on Friday, while the French CAC 40 closed higher by 1.07%.

Top European Stocks of the Week

Shares of Thyssenkrupp tumbled more than 14% to €5.21 on Monday after the German-based company said it expects a new cash squeeze due to the coronavirus outbreak despite selling its elevator business.

BMW posted a strong rise in its operating profits for the latest quarter, while warning of a steep decline in its earnings for 2020 due to the pandemic. BMW’s shares dropped almost 5% on Wednesday.

The Forex Market

The Canadian dollar rose against the greenback on Friday, adding gains to its weekly tally after the US reported a surge in job losses, while Canada’s figures came in well below expectations. The Lonnie gained 0.2% to 1.3938 versus the US dollar on Friday, rising 0.8% for the week. Canada lost 2 million jobs in April, versus the 4 million projected by economists.

The Australian dollar surged versus the greenback during the week, rising above the 0.65 level. The US dollar has been easing with a rebound in oil prices soothing nerves, while China’s recovery in exports spelled good news for Australia, pushing its currency higher and adding to its 6.1% rise for April.

The Crypto Market

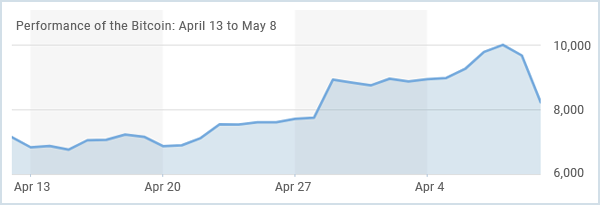

Bitcoin prices surged on Thursday to cross the psychological barrier of $10,000. The leading cryptocurrency rose above this level for the first time since February, as investors eagerly awaited bitcoin’s halving event, scheduled for this week. Bitcoin prices rose around 2% on Thursday night, after gaining more than 36% last month.

Despite this feat, the digital currency closed Saturday on a negative note, moving down around 15% to 8,221.91. Bitcoin had last traded at above the $10,000 mark on February 24, only to tumble below $4,000 in March.

Leave A Comment

You must be logged in to post a comment.